Blue Planet Studio/Getty

- The current ratio measures a company's capacity to pay its short-term liabilities due in one year.

- The current ratio weighs up all of a company's current assets to its current liabilities.

- A good current ratio is typically considered to be anywhere between 1.5 and 3.

- Visit Insider's Investing Reference library for more stories.

When determining a company's solvency 一 the ability to pay its short-term obligations using its current assets 一 you can use several accounting ratios. The current ratio is one of them. The current ratio is a measure used to evaluate the overall financial health of a company. Here's how it works and how to calculate it.

What is the current ratio?

The current ratio, sometimes referred to as the working capital ratio, is a metric used to measure a company's ability to pay its short-term liabilities due within a year. In other words, it shows how a company can maximize current assets to settle its short-term obligations.

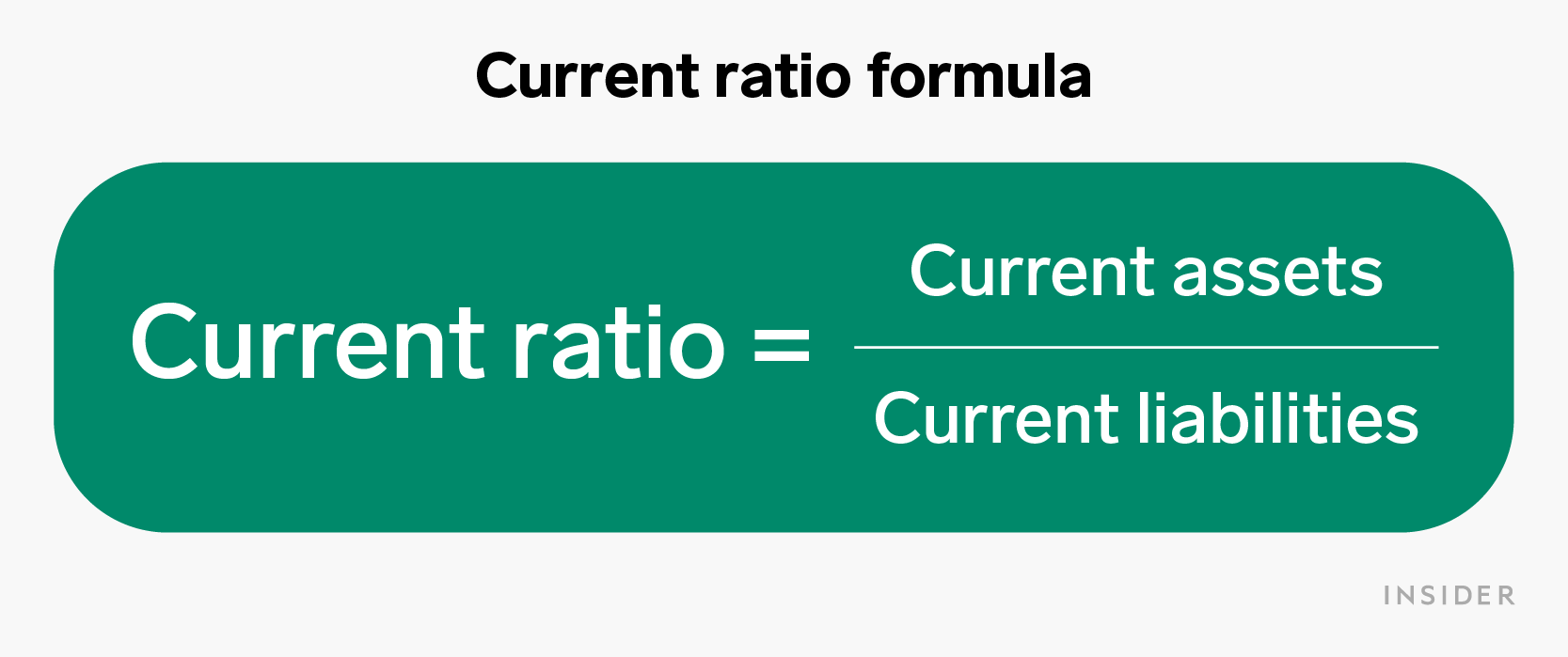

"The current ratio is simply current assets divided by current liabilities. A higher ratio indicates a higher level of liquidity,"says Robert Johnson, a CFA and professor of finance at Creighton University Heider College of Business.

How current ratio works

When you calculate a company's current ratio, the resulting number determines whether it's a good investment. A company with a current ratio of less than 1 has insufficient capital to meet its short-term debts because it has a larger proportion of liabilities relative to the value of its current assets.

On the other hand, a company with a current ratio greater than 1 will likely pay off its current liabilities since it has no short-term liquidity concerns. An excessively high current ratio, above 3, could indicate that the company can pay its existing debts three times. It could also be a sign that the company isn't effectively managing its funds.

The current ratio can help determine if a company would be a good investment. But since the current ratio changes over time, it may not be the best determining factor for which company is a good investment. This is because a company facing headwinds now could be working toward a healthy current ratio and vice versa.

How to calculate the current ratio

The current ratio is calculated using two common variables found on a company's balance sheet: current assets and current liabilities. This is the formula:

The resulting figure represents the number of times a company can pay its current short-term obligations with its current assets.

Current Assets

Current assets are all assets listed on a company's balance sheet expected to be converted into cash, used, or exhausted within an operating cycle lasting one year. Current assets include cash and cash equivalents, marketable securities, inventory, accounts receivable, and prepaid expenses.

Current Liabilities

Current liabilities are a company's short-term obligations due and payable in one year or one business cycle. Common current liabilities found on the balance sheet include short-term debt, accounts payable, dividends owed, accrued expenses, income taxes outstanding, and notes payable.

What's considered a good current ratio?

Some companies in specific industries may have their current ratio below 1, while others may exceed 3.

"A good current ratio is really determined by industry type, but in most cases, a current ratio between 1.5 and 3 is acceptable," says Ben Richmond, U.S. country manager at Xero. This means that the value of a company's assets is 1.5 to 3 times the amount of its current liabilities.

Current ratio vs. quick ratio

The current ratio is similar to another liquidity measure called the quick ratio. Both give a view of a company's ability to meet its current obligations should they become due, though they do so with different time frames in mind.

The current ratio evaluates a company's ability to pay its short-term liabilities with its current assets. The quick ratio measures a company's liquidity based only on assets that can be converted to cash within 90 days or less.

The key difference between the two liquidity ratios is that the quick ratio only considers assets that can be quickly converted into cash, while the current ratio takes into account assets that generally take more time to liquidate. In other words, "the quick ratio excludes inventory in its calculation, unlike the current ratio," says Robert.

The financial takeaway

The current ratio measures a company's capacity to meet its current obligations, typically due in one year. This metric evaluates a company's overall financial health by dividing its current assets by current liabilities.

A current ratio of 1.5 to 3 is often considered good. However, when evaluating a company's liquidity, the current ratio alone doesn't determine whether it's a good investment or not. It's therefore important to consider other financial ratios in your analysis.